|

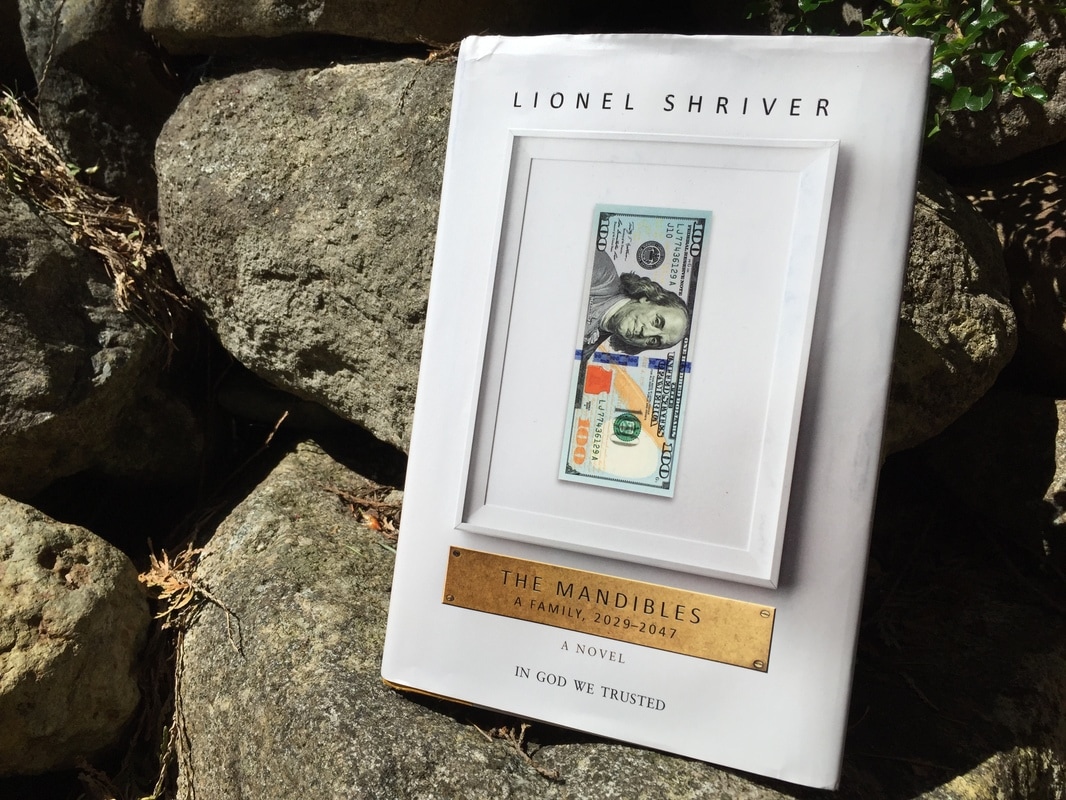

Is a monetary crisis the real threat, and if yes, what will it look like ? While climate change appears to be the one existential threat to civilization to some and mass immigration to others, it can be argued that the far more imminent one is monetary collapse. Lionel Shriver takes on this theme in her latest novel, ‘The Mandibles: A Family, 2029-2047’. In it she paints an in my opinion unusually realistic view of how a once wealthy family is reduced to poverty and famine as the value of the once mighty US Dollar evaporates. Shriver’s trademark approach is to take on some current issue and frame it into a unique and often dark fictional narrative with character studies that leaves you wondering if you have to read the whole book again as it is not only that good, you are still ridden with a myriad of questions about each protagonist in the book. She has successfully taken on America’s ongoing healthcare trauma in ‘So Much for That’, obesity in ‘Big Brother’ and extreme school violence in ‘We Need to Talk About Kevin’. The latter was turned into a movie with Tilda Swinton and the story leaves you wondering about the horrendous reservoirs of misery that the human mind can apparently sink to. Beyond depressing, but a captivating read. ‘The Post Birthday World’ on the other hand is far more upbeat and captures an extra-marital affair in minute detail, exploring two different outcomes: if a kiss had or had not happened. So my expectations for her latest tome, ‘The Mandibles’, were quite high and Shriver does not disappoint. On the contrary, she has taken her social commentary to a new level altogether. It would be hard to describe the book and not give away its plot, but in short it comes down to the greenback losing its value and the countries that have so generously advanced money to the debt-addicted American nation now seek repayment by other means. The world’s reserve currency is now the ‘bancor’ and America’s first Latino president resorts to extreme measure to ensure that the nation’s debt can be repaid in order to avoid a looming war with, among others, China. As we have seen in real-life with Greece’s debt crisis, the pain of drastic monetary action falls on the citizenry and so it falls on the Mandible family whose journey we follow over a 25-year period. Again, what makes Shriver’s writing so compelling is the plausibility of her fiction. In many ways we have already and consciously started the downward journey to a world where the greenback is no longer valuable and where we have to find our way back to gold and other instruments, like bitcoin, that store and preserve value. It is not hard to imagine a world without currencies and cash and just imagine if we did away with it all, would the physical world not look exactly as it is now? A house is still a house, with or without a mortgage contract, right? The Mandibles is almost a piece of basic economic theory explaining how the artificial monetary construct on which we have built our society is vital in sustaining our physical world and pretty much all relations that govern our lives. Once money evaporates, the world around us changes so much that our core foundations get uprooted to such an extent that everything around us falls apart and gets destroyed. Rip up a mortgage contract and your house will all of a sudden look very different, that is what Shriver’s book tells us. So yes, although fiction, the book is a piece of social-political commentary that resonates deep in the current environment, something that Shrives alludes too when referring to the 2008 financial crisis. In her book, Keynesian budgetary policies are demonstrated to have outlived their usefulness and a tech empowered welfare state that is used as an outsourcing center for the world’s new economic powerhouses (China, India) stand out as examples of our near term economic prospects. The crowning piece however is a libertarian nirvana that has seceded from the United States. On close inspection however it is nothing less than a Darwinian struggle for survival where the absence of government supported healthcare and rampant crime are the inescapable side effects for those that seek to claim one of the last remaining pieces of freedom on planet earth. As dry and haunting as this may sound, Shriver brings this dark vision of our future to life with some phenomenal protagonists that span four generations. The kids that are our current day millennials, the post-boomers, boomers as well as the last representative of the greatest generation embodied by the Mandible pater familias ‘Great Grand Man’ whose fortune everyone is after are condemned to each other and to figuring out life without the hoped for family fortune. As a consequence, each family member has to fend for his or her own interests. And Shriver dives right into her knowledge of self as she describes the impact of the economic crisis on the generation that ultimately carries the most guilt in our monetary undoing: the baby boomers. Obsessed by self-interest, health and eternal youth, these are the ones that have to fight hardest to accommodate the most to the unforgiving post-dollar world. One of them, Nollie Mandible, is the boomer that is able to redeem herself and is in all likelihood Shriver herself as she paints the way out of the disaster that has effectively destroyed the United States as we know it. It did not take me long to finish the book, it was that riveting a read, blending personal fictional drama with a fairly plausible analysis of the world’s future if we keep borrowing and printing money. It is after all not that hard to fathom that at some point this century Indonesia will invade Australia, yet it takes some dark futurology to invoke it in a novel as an entirely logical outcome of a re-ordered world. Shriver does that, with both humor and substance, and has put down a book that we all should read and reflect on while we still have our hands on the monetary steering wheel.

2 Comments

The region’s first angel investment conference aligns entrepreneurs and funders for a diversified regional economy

Last week I attended and presented at the Caribbean Angel Investor Forum in Montego Bay, Jamaica, the first conference of its kind. Jointly organized by the Caribbean Export Development Agency and the World Bank. The goal was to put angel investing in the Caribbean on the map and seek to professionalize the emergence of a new asset class which can be a key driver for economic growth and job creation. It was hoped that it could also deal with debunking the stereotype of angel investing as some sort of game for the wealthy only. Not only do many people invest at the angel level these days, they do this in combination with offering mentoring start-ups and helping to build ecosystems that will support stronger and above all more diversified economies. A number of angel investors, lawyers, entrepreneurs and government officials from all over the Caribbean as well as the US and Canada exchanged ideas and above all sought to learn from each other. The Caribbean has not been immune to global shifts and the Trinidad delegation pointed out that their economy could no longer take oil revenues for granted and that diversification of the economy through angel deals was a necessity for them. While each country had its own issues, it was key to bring them on all on the same page with regards to proper angel investing. It was therefore good that at the opening Tomi Davies from Nigeria laid down very clearly that early stage investing was primarily investing in people and building long-term relationships. It was relatively easy for me to expand on that theme by explaining that I had seen well-funded companies with great technologies fail, while I had seen relatively lower-tech companies with limited amounts of cash flourish simply because of the people involved. While in some Caribbean countries the concept of angel investing has only just taken hold, others are making solid progress and have raised the bar significantly. In the latter category falls First Angels Jamaica, which has built up a small portfolio of interesting investments but above all has developed a very disciplined investment approach. At the same time they are lobbying for government and regulatory support, which will benefit all Jamaican investors and entrepreneurs. Its chairman, Joseph Matalon, opened and closed the conference and not only shared his experiences to date but pointed to the challenges in getting government support. In that he elaborated on the fact that politicians are driven by election cycles and that building ecosystems where angels invest and nurture emerging companies takes much longer. This is something we have seen in Canada as well where the focus on natural resource projects somehow always outranks entrepreneurial activity during election cycles. In any case, Jamaica’s minister of state for finance, Fayval Williams, was present to hear this message and took the opportunity to summarize the progress the island state has made and emphasizing the fertile ground it now is for entrepreneurial activity. It was timely that the NACO common documents had just been launched so I could give some depth and materials to my workshops on deal structuring and due diligence and share some vital education with the Caribbean community. There was energy and a clear thirst for knowledge on how to negotiate financings, how to create solid working relationships with entrepreneurs, and equally important, how to get angel investors to work together: share deals, pool funds and do due diligence together in an organized way. The best part of the conference for me were the entrepreneur sessions. A number of regional start-ups pitched their ideas followed by ‘speed-dating’ at a number of tables. The impressive thing was not only the quality of the pitches – they would easily be very competitive in a North American setting – but the visionary and global approach each entrepreneur took. They all understood that their market was pan-Caribbean and global and their plans and ambitions more than underlined that. A much needed emergency platform, an extremely energetic candy manufacturer, a Caribbean Uber-type transportation play, an in-ABM advertising deal that generated some interesting revenue streams and a platform for stroke and elderly patients brought the audience to action. It was great to have dinner afterwards with a few of them, one local entrepreneur had graduated from MIT, set up his mobile survey conversations start-up in Kenya and had now stopped at the conference on his way to Silicon Valley to talk about his Series A financing. Global thinking in action indeed. So there is no lack of ambition and willingness to finance and nurture an emerging angel and start-up ecosystem in the Caribbean and kudos to those that have taken the plunge in making it happen. But there are some major hurdles too. Lack of capital is not one of them according to most of the participants although some time was spent on figuring out how to mobilize the Caribbean diaspora to invest back home, much like ethnic Chinese have done when their country roared back to growth in recent decades. Lack of investable deals however was the key and most cited issue. Building deal flow not only requires patience, it also is a matter of education, mentoring and changing a mindset as is engaging with local universities and possibly enticing diaspora talent to come back and start companies. Add to that the common complaint that local entrepreneurs often lack the maturity to negotiate a deal and be mentored and it became very clear where the energies are to be focused. A combination of education and trial and error will in the end yield results and this is exactly what Matalon alluded to when he spoke about the time and effort involved in building successful start-up ecosystems. The key driver for this however in the end is success. Not until the first early stage deals grow, become success stories and generate exits, will the larger environment take notice and mobilize new entrepreneurial minds who have seen that it can be done while also unearthing new pools of capital. While each participant came away with different insights and ideas, all of them were energized. At the same time they were armed with a good sense of reality by understanding in what areas work needs to be done going forward. The first Caribbean Angel Investor Forum was a well-organized effort and a good start to get that process going. Keep your eyes open for the next emerging start-up market. |

Archives

April 2020

Categories

All

|

RSS Feed

RSS Feed